Emerging Trends in Real Estate is a trends and forecast publication undertaken jointly by the Urban Land Institute and PricewaterhouseCoopers. This publication is considered by many as the best researched real estate periodical of its kind. Their 2010 edition reflects the views of more than 900 real estate professionals. Their forecast for this coming year isn’t pretty; in fact to be blunt, it’s downright ugly.

This publication is considered by many as the best researched real estate periodical of its kind. Their 2010 edition reflects the views of more than 900 real estate professionals. Their forecast for this coming year isn’t pretty; in fact to be blunt, it’s downright ugly.

I have divided their forecast into two parts – today summarizes their 2010 predictions for commercial real estate. The following week will focus on their thoughts about financing trends for the coming year.

For the weak-hearted, you may want to stop reading any further. Their forecast:

For the weak-hearted, you may want to stop reading any further. Their forecast:

- The commercial real estate industry will hit bottom in 2010. Values will ultimately decline 40 percent of the mid-2007 pricing peak making it the worst decline in property values since the Great Depression.

- A lackluster economic recovery characterized by problematic job growth will hamper the pace of any real estate market resurgence.

- Rents and occupancy rates will continue to fall well into 2010 further hurting prospects of weakened owners securing financing on properties where loans come due during the year.

- Retail and office properties will take the biggest hits. Debt burdened consumers will continue to rein in shopping and companies will delay hiring while looking to shave occupancy costs.

- Apartments should rebound more quickly than other sectors thanks to pent-up demand from the expanding population of young adults tired of living with parents or roommates.

- Developers will go on enforced holidays. Slack demand will push up vacancies and many new projects will not meet leasing projections or debt service obligations. In many markets values will sink well below replacement costs. Development doesn’t pencil out when investors can buy existing real estate at bargain basement prices.

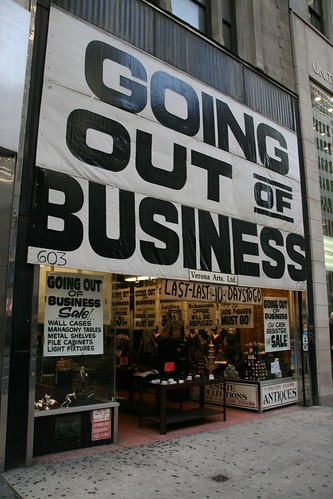

I believe that 2010 will be a watershed year for those of us in the commercial real estate industry. As bad as the market has been, we have not seen a proportional number of people getting out of the business as I would anticipate.

I believe that 2010 will be a watershed year for those of us in the commercial real estate industry. As bad as the market has been, we have not seen a proportional number of people getting out of the business as I would anticipate.

That will change this year. Those who have been hanging on by their fingernails will either make deals happen or will decide it’s time to find another profession.

For those of us who survive this year we can take solace in the words of the great philosopher Friedrich Nietzche: “What doesn’t kill us makes us stronger.”

Source:

Emerging Trends in Real Estate 2010, Urban Land Institute & PriceWaterhouseCoopers.

No comments:

Post a Comment